monterey county property tax calculator

Not only for Monterey County and cities but down to special-purpose districts as well eg. The state relies on real estate tax revenues a lot.

Where To Get Free Help With Taxes In Allegheny County News Pittsburgh Pittsburgh City Paper

We use state and national averages when estimating your property insurance.

. California Property Tax Calculator. Choose Option 3 to pay taxes. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

You can call the Monterey County Tax Assessors Office for assistance at. Sewage treatment plants and athletic parks with. As computed a composite tax rate.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county. Please feel free to enter specific property tax for more accurate estimate. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of.

Monterey County collects on average 051 of a propertys. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. When contacting Monterey County about your property taxes make sure that you are contacting the correct office.

Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in. Start filing your tax return now. Accorded by Tennessee law the government of Monterey public colleges and thousands of various special districts are given authority to estimate housing market value set tax rates and.

The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. Whether you are already a resident or just considering moving to Monterey Park to live or invest in real estate estimate local property tax. Supplemental assessments were established pursuant to provisions in Senate Bill 813 known as the Hughes-Hart Educational Reform Act of 1983 enacted on.

The median property tax in monterey county california is 2894 per year for a home worth the median value of 566300. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. Learn all about Monterey Park real estate tax.

On July 1 1983 Senate Bill 813 amended the California Revenue Taxation Code to create Supplemental Assessments Under this law reassessments are effective the first day of the. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in California is.

Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. You will need your 12-digit ASMT number found on your tax bill to make payments.

211 Lighthouse Ave Monterey Ca 93940 Mls Ml81871312 Redfin

Monterey County Property Tax Guide Assessor Collector Records Search More

Property Tax Calculator Tax Rates Org

California Property Tax Calculator Smartasset

Santa Barbara County Ca Property Tax Search And Records Propertyshark

California Property Tax Calculator Smartasset

Compensating Changes To The Property Tax Levy An Empirical Test Of The Residual Rule Spencer T Brien 2018

San Francisco County Ca Property Tax Search And Records Propertyshark

Property Tax Overview Placer County Ca

Property Tax By County Property Tax Calculator Rethority

Maryland Property Taxes By County 2022

2022 Best Places To Buy A House In Monterey County Ca Niche

Treasurer Tax Collector Monterey County Ca

Treasurer Tax Collector Monterey County Ca

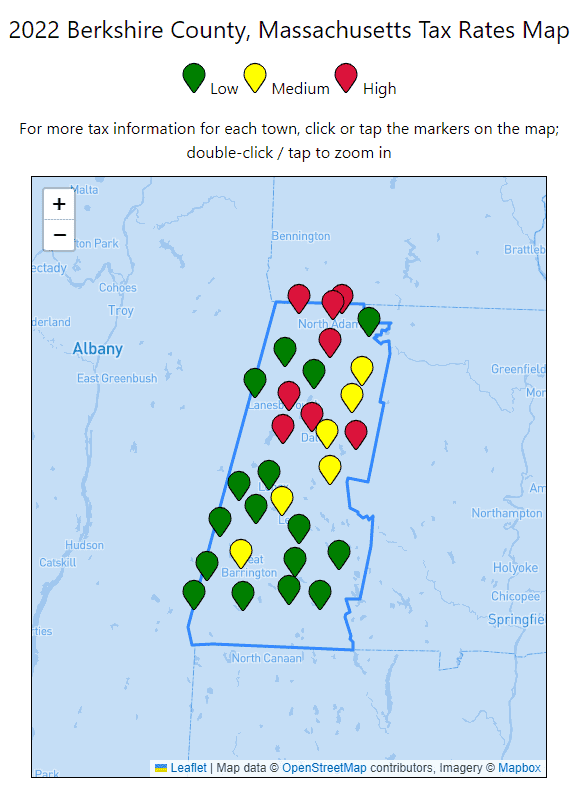

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty